Knowledge centre

RI's Knowledge centre

Keeping up to date is important, so here's the news.

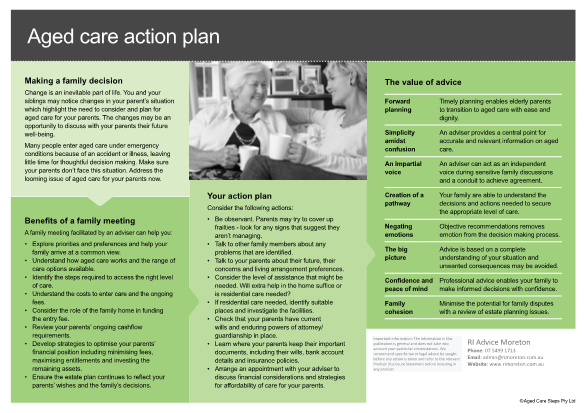

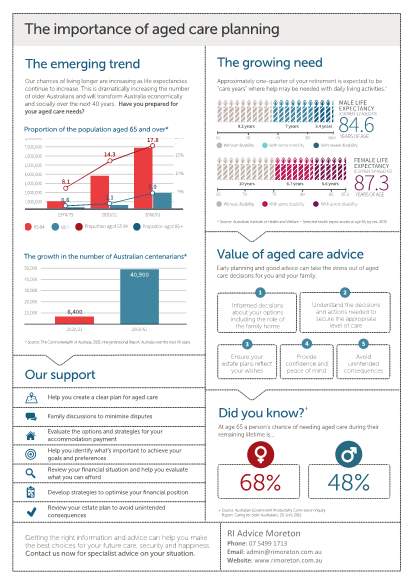

When your family gathers over the festive season, it might present an opportunity to start planning for future care needs.

New Year’s resolutions help you focus on what you would like to achieve in the coming year. Financial resolutions can be particularly beneficial, especially if you’re serious about following them through. Here are some suggestions to get you started.

Take a break – without breaking the bank Holidays should be a well-deserved break from worry. Here’s how to minimise your stress and have a relaxing time away.

How to deal with market volatility Market volatility can be a curse or a blessing… It all depends on how ready you are to deal with it...

Teaching your kids healthy money habits. With a few simple changes, you could set a good example for your children.

As kids grow older, their financial needs – and their opportunities – grow more complex. If you have done the groundwork and taught your children the benefits of budgeting and saving, it will be much easier to talk to them about managing their finances in their teens and beyond. Teaching good money management early will help them make informed financial decisions over the long term.

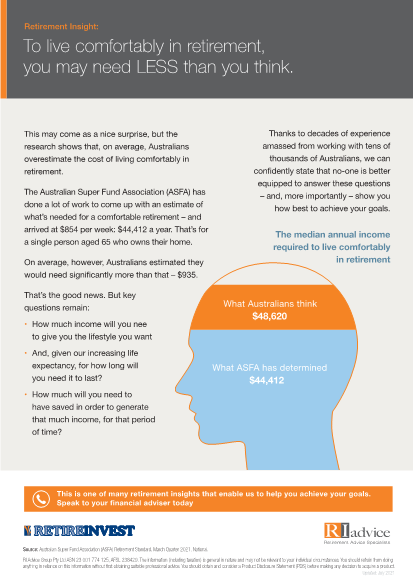

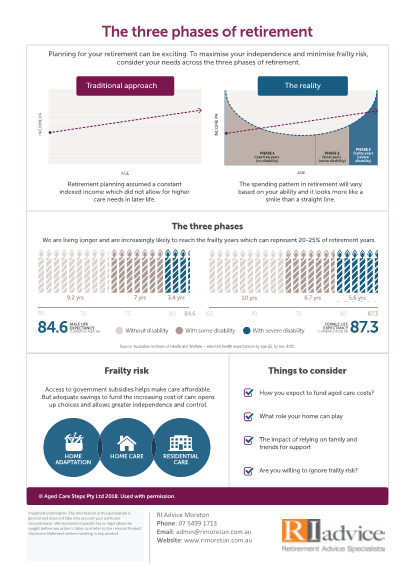

You need to be savvy to build a sufficient nest egg for retirement. Planning is key, and so is getting professional advice. Most Australians are not saving enough for retirement and risk running out of money sooner than they expect. Data shows that in 2015–16, Australians had average superannuation balances of only $270,710 for men and $157,050 for women at the time of retirement.1 These sums are significantly lower than the $545,000 that the Association of Superannuation Funds (ASFA) estimates singles need for a comfortable lifestyle in later years.

First-home buyers get some help State and federal governments are creating new incentives to help first-home buyers get into the overheated housing market...

Whether they’re saving for a house or a holiday or seeking to grow or preserve their family wealth, setting up and sticking to a budget can help couples attain their common goals. By handling money well, they can avoid disagreements that could put a strain on their relationship.

It’s an important skill but many people are still not as financially literate as they should be. Here are some ways that may help you improve.

Windfalls such as salary bonuses and inheritances are more common than many people think. An Australian survey showed that 85% of seniors are likely to leave an inheritance for their children, with an estimated $3.3 trillion pledged1.

When things go wrong, it’s nice to know you’re covered. But getting suitable insurance cover can be a matter of getting professional advice.

The urge to donate is strong in Australia, and it’s easy to make it part of your financial plan. An estimated 14.9 million Australian adults (80.8 per cent of the population) gave $12.5 billion to charities and not-for-profit organisations in 2015–16.

If you’re organised with your finances, the high cost of living doesn’t have to mean diminished savings.

Budget offers an incentive to downsize The 2017 Federal Budget encourages some older people to downsize from homes that no longer meet their needs to free up housing stock for young families...

In your 40s and still not financially secure? Don’t fret. You can still catch up.

Life insurance policies don’t have to cost an arm and a leg. Here are tips for making them more affordable.

Sometimes you can’t avoid debt in a business. You may have to take out a loan, for example, to increase production or expand your business offerings. But piling up a lot of debt may leave your business in financial difficulty or, worse, bankrupt. So it’s vital to manage your debt before it gets out of hand. Here are some practical suggestions to consider.

On 8 May 2018, the Turnbull Government announced in the Federal Budget that there could be changes to personal income taxation commencing 1 July 2018. These proposed changes included: • introduction of a new temporary Low and Middle Income Tax Offset (LMITO) payable over four financial years • progressive changes to personal income tax thresholds. Since the announcement was made, the changes have now passed Parliament and await Royal Assent, which is usually just a formality. With this in mind, we take a look at what these changes may mean for you.

Preparing for retirement can be difficult for parents who have dependent children to support. They may find themselves torn between saving for retirement and setting aside money for their children’s education or other needs. Even adult children ask their parents for financial help; one survey found that more than half of Australians aged 18 to 35 borrow regularly from their parents, including to get help with big purchases or university fees.

First-home buyers can now use their super to save for a house deposit, thanks to the First Home Super Saver scheme. Exorbitant property prices have made entering the market a pipe dream for many first-home buyers. They need to find more than $175,000 for a 20 per cent deposit to buy a house in Sydney at the median value of $878,325, according to CoreLogic data

Market Highlights, Onwards and upwards Global growth indicators continued to firm through November as inflation expectations rose on the back of higher levels of industrial activity. Share markets, especially...